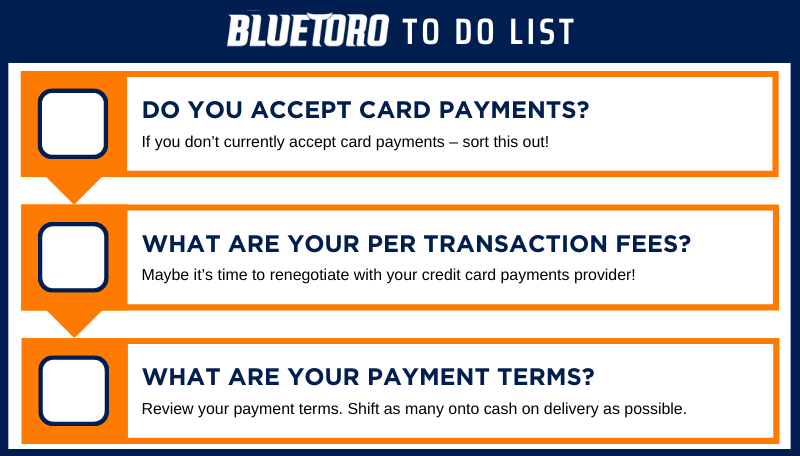

STEP 1: ACCEPTING MONEY

COD is key!

Do you offer EFTPOS payments? How many jobs are you providing credit for? One of the easiest ways to help your cash flow is to accept all money at the time of job completion. This means ensuring ‘cash on delivery’ payment terms and providing EFTPOS as a payment option.

EFTPOS

You’d be surprised how many businesses we come across that have not setup EFTPOS. They may think it’s expensive or have not got around to it. The truth is if you’re not accepting EFTPOS, you’re keeping the cash in your customers pocket not yours which is costing you money.

Most people don’t carry much cash these days. And most people have a debit or credit card. So, no excuses not to use EFTPOS. Accepting EFTPOS transactions not only provides a better service to your customers, it also means the cash is in your bank account the next day. The sooner the cash is in your bank, the easier it is to pay bills.

HOW TO CHOOSE THE RIGHT EFTPOS

They are all very similar in features and price. You can get one through your current bank (1st and 2nd tier banks only). Or there are some alternates on the market.

- It’s usually easier to opt for your current business bank. This way your funds will hit your business transaction account the next day. However, it’s worth comparing prices.

- Don’t bother going into a branch – they’ll just have to refer you and it takes longer. Contact the Merchant Services team of your local bank. You can find the number on your bank’s website. Most work extended hours.

- We use and recommend the CBA for merchant facilities. They are the largest EFTPOS provider in Australia and usually have the best rates. They have a special rate for MTA members. You don’t have to be an MTA member to access it. As at time of writing the rate was 0.79% for credit card transactions and 19c for debit transactions. If you’re paying much more than this, you’re paying too much.

- Don’t be suckered into a package deal or flat rate. It’s almost always cheaper to opt for a pay-as-you-go type model. That is, you pay based on your month’s turnover.

- All bank EFTPOS terminals require a monthly leasing fee. The cost is usually around $35p.m. The benefit of leasing is you will be upgraded to the latest models when available and your terminal will be replaced if it’s not working.

WHAT ABOUT EFTPOS ALTERNATIVES?

There are non-bank alternatives on the market. The key difference between a bank and non-bank is the pricing. A bank will lease you the terminal for a monthly fee, however, the transaction fees are lower. A non-bank won’t charge you ongoing rental fees, but their transaction fees are much higher.

As a guide:

- If you’re turning over under $10k per month you’re probably better off with a non-bank option. No monthly fees, however, your transaction fees will average about $7-9 per transaction.

- If you’re turning over more than $10k per month you’re probably better off with a bank option. You will pay around $35p.m. to rent a terminal. However, your average transaction fee will be around 19-30c for a debit card, and $3-6 for a credit card.

The most popular and highest rated non-bank payment option on the market is Square. You can purchase a square card reader at Officeworks for $59. You can then set up the app on your phone.

PAYMENT TERMS

If you’re not trading on COD terms, then you really need to ask yourself why. In our experience the more credit terms you provide to more customers, the more time you spend chasing cash, and the higher the risk of customers not paying.

It’s important to set expectations up-front that your trading terms are COD. This should also be on your invoices. Of course, you need to be providing an invoice at the time of payment (or by the end of the day) if you’re requesting COD.

There are times when you will need to or choose to provide payment terms. Fleet companies are a classic example. Businesses may request payment terms, but just because they’re a business does not mean they’re good payers. Our tip is to request COD the first 1-2 jobs you do for a new business customer. Then add them to payment terms. Most businesses are happy with this arrangement.

If you do accept payment terms, try and reduce the terms as much as possible. 7 days is better than 14-day terms. And 14-day terms are better than 30. Remember you’re paying for your parts on 30-day end of month terms. You don’t want to be paying for your parts before you’re paid!

If you have been providing credit to many of your customers, consider whether you can make some changes. You can ask some of your customers to start paying with a credit card. Or you can let your customers know that you’re trading terms have changed from 30 days to 14 days for example. Any tweak you can make will help your cash flow.

If you do continue to offer credit, ensure you have a good collection process in place. Your bookkeeper should be able to help you manage this.

THE SOONER YOU INVOICE THE SOONER YOU GET PAID

For COD payments you really need to invoice at the time of payment, or at least the same day. When someone hands over a payment, they expect a receipt.

For customers on credit terms, they won’t put you in their payment ‘queue’ until they receive an invoice from you. If you wait a few days to send an invoice, that’s potentially an extra few days that you’re not being paid.