Cashflow is king!

One of the biggest mistakes we see business owners make is

1) not paying themselves enough; and

2) not putting money aside for the big bills such as parts and tax.

Having an effective budget in place will help make sure everything is paid, and help you sleep at night. In fact, we’ll go as far as saying that not having an effective budget in place is the biggest cause of businesses failing.

PROFIT FIRST

The Profit First concept is that you develop separate ‘buckets’ of money that you allocate your revenue too each week. Having a ‘bucket’ dedicated to things like tax and parts ensures that everyone is being paid. The name profit first is the concept that you should be taking a profit out of the business before paying anybody else (regardless of how small).

We believe putting this in place will change your life. We certainly believe this education should be provided to anyone applying for an ABN.

SET UP MULTIPLE BANK ACCOUNTS

Every automotive business should have a core set of bank accounts to allocate revenue to:

- Income: Where all revenue is deposited to

- Parts: To cover your parts expenses

- ATO_Super: To ensure you can pay your GST/ PAYG/ Biz tax/ Super when it falls due

- Profit_Debt: To allocate yourself a profit and pay any business debt you may have

- Salary: This is your salary. You can use your existing personal bank account

- Operations: Your operating account where expenses are paid from

This may feel a little overwhelming at first. But stick with us. You will have at least 1 business transaction account already set up. Continue to use this for your revenue account as your customers and your EFTPOS terminal will already be linked to this. You will also have a personal account set up for your personal funds.

You can set up the remaining accounts in your internet banking, or by phoning your bank. Your bank should offer fee-free accounts. If they don’t switch to one that does. You shouldn’t have to pay the bank to keep your money with them.

Most internet banking will allow you to rename your accounts so they’re easily recognisable.

SPLIT YOUR MONEY BETWEEN DIFFERENT BUCKETS

Once you have your new accounts set up it’s time to allocate money to each bucket each week. To do this you need to work out how much to add to each bucket and in what order.

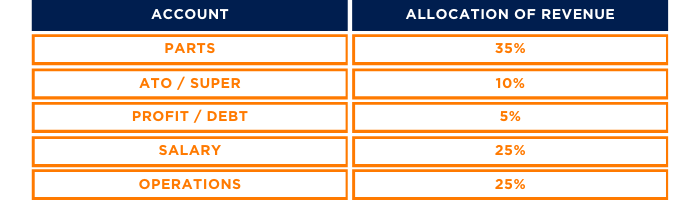

Here’s a rule of thumb to suit a single operator repairer:

There’s a big chance that your current allocations are split differently. We know for example that most independents are paying well above 35% of their revenue on parts. So, to get from where you are now to where you want to be it’s important to first understand where your money is currently going. You can then start to shift the percentages over time, to get to where you want to be.

To complete this step, ask your accountant to provide you with a split for each of the buckets of where your money went last financial year. Setup your allocations to reflect your NOW position. To get to your target position you will need to slowly work on reducing your expenses and increasing your profit and salary. Shifting your allocations just 1% at a time will help you slowly move to your target while ensuring you still have enough now to pay your bills.

Typically, at this point we see business owners spending too much on parts. Go back to week 3 to review how you can reduce your parts expense. It is likely to be a combination of better pricing, increasing your rate and reducing your parts expense through Blue Toro.

GETTING INTO A RHYTHM

Once you have your buckets and allocations worked out it’s important to move the money on a regular basis. Once a week makes most sense. Put aside 15mins at the same time each week – Sunday morning usually works best. And then follow these steps:

- Add up all the cash that hit your income account this week (Mon-Sat)

- Calculate the % for parts – move this money to your parts account

- Calculate the % for ATO_Super – move this to your ATO_Super account

- Calculate the % for Profit_Debt – move this to your Profit_Account

- Calculate the % for Salary – move this to your Salary Account

- The rest move to your Operations account

USE A GOOD BOOKKEEPER

The first person you hire into a business should always be a bookkeeper. This comes before an accountant. A good bookkeeper will save you more money than they cost. They will also remove the headache of reconciling, chasing overdue money and being tax ready.

If you don’t have a bookkeeper now is the time to get one. Ask your accountant, ask other business owners for a referral. Make sure when you choose a bookkeeper, they can do 3 things:

- Use electronic accounting, i.e. xero or myob. If they want to see paper receipts run a mile

- Can do your BAS. Your accountant may be doing this now however we find too much of a double up if bookkeepers are doing all the work, and your accountant comes in at the last minute. Accountants play a role at end of year tax time, tax planning and looking forward. Bookkeepers play a good role in the day to day to keep you compliant and help with cashflow

- Know the Profit First system. If your bookkeeper can help you allocate your expenses into your buckets all the better. If they haven’t heard of Profit First you can send them too profitfirstfortradies.com.au/toolbox/WhatIsProfitFirst

GO ELECTRONIC

Gone are the days of paper receipts in shoe boxes. Everything is electronic now. Using an electronic accounting system like Xero will make your life so much easier. Your bookkeeper and accountant can log in and manage everything for you. All you need to do is send them your receipts electronically.

NEVER MIX BUSINESS WITH PLEASURE

You should never mix your personal and business funds. This is the easiest way to run out of money and struggle with cash flow. Set your salary. Move that to a personal account. And then don’t use your business account for personal use – ever!

THE EASY OPTION

Here’s an easier option for those who want a shortcut. It’s not as effective but it will help you save for the big bills.

First work out the salary you need to take from the business. This should be a realistic salary, not a wishful thinking salary. You can ask your accountant what you paid yourself last year. You can also ask your partner to work out the household budget and what you need to be bringing home.

Once you have a weekly take home figure, setup a weekly recurring payment from your internet banking. If that figure is $1,000, set up a $1,000 transfer on the same day each week. This should be transferred to a personal account. That’s your salary – that’s it. No dipping into the business account during the week.

If you stick to this the rest of the money will accumulate each day. When your larger bills are due there should be enough left in your business account to cover all of your expenses. If there is still money left at the end of the quarter once you’ve paid for your parts, BAS, super and any tax – then you’ve made a profit! Time to treat yourself or put this money away for a rainy day.

If you still don’t have enough to cover all of your expenses, then you have a bigger issue here – your business is not making enough money. Go back to week 3 and review your pricing again. Stick with the 6-week challenge for other tips to improve your bottom line.

It’s time to look after your money. How can you become better at budgeting?